End of Financial Year 2024 - Empower Help Guide

Opening a new financial year:

Prior to the beginning of April (for financial year ending 31/03/2024), a new financial year will need to be opened.

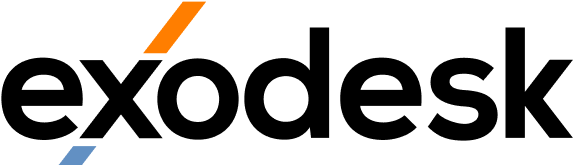

To complete go to Tools, Global Options, Calendar

In the ‘Year’ column on the right, check if 2025 is showing, if it is not;

Add in the 2025 year by clicking on the Insert Year at End button.

Change the General Ledger “Open To” date to the end of the new Financial Year 31/03/2025.

Click Apply & OK.

Close last years accounting periods:

When all transactions for your financial year to 31st March 2024 have been entered, it is a good practice to close the calendar to ensure no further entries are keyed with incorrect dates.

After finalising your 31st March 2024 ensure all Accounts Payable and Accounts Receivable invoices credits and payments/receipts have been entered.

Complete your bank reconciliation and GST, then close the calendars and run your required reports.

The steps to complete the close are:

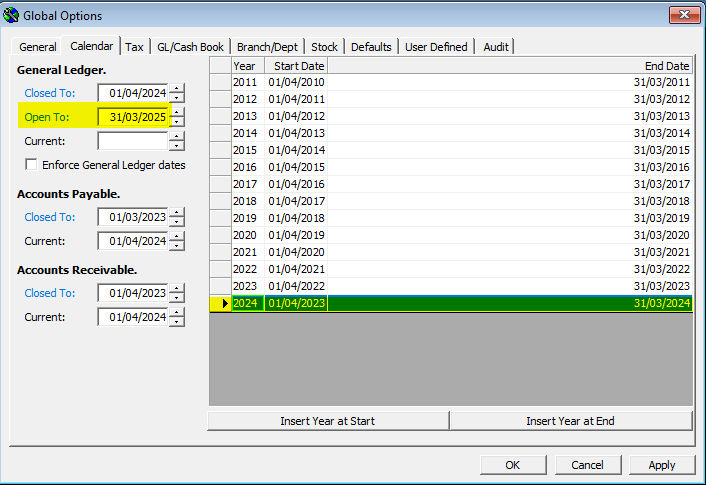

Step 1: Go to Tools, Global Options, Calendar

On the General Ledger change the “Closed To” date to 01/04/2024

On the Accounts Payable and Accounts Receivable calendars, change the “Closed To” date to 01/04/2024,

(this may not be required if you are several months into the new year).

Please tick, enforce General ledger dates (recommended).

Step 2: Review EOY Transfers

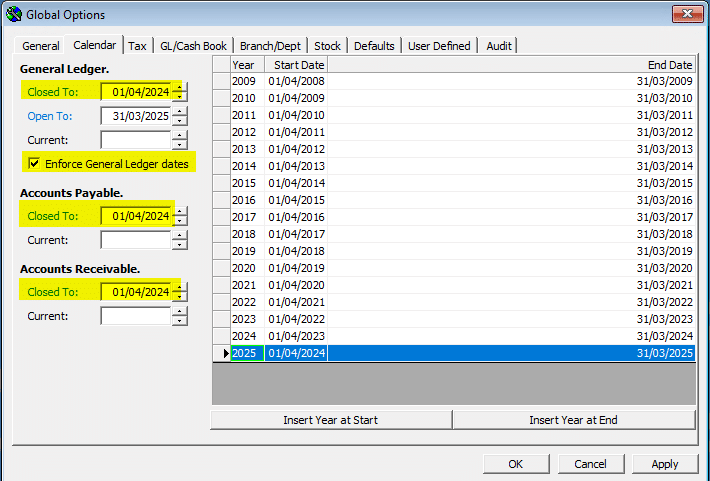

In the lower left-hand corner of your emPOWER screen you may have the following message

To clear this message & revise the End of Year Transfers:

Go to Process, Year End, Revise EOY Transfers. Ticks will automatically appear in the “revise column” for years that require the process to be run. Click OK

When the transfers are complete, the screen will refresh and no ticks will be present.

This process can be run as many times as required.

Close the window and sign out of emPOWER and log on again. If the message remains, you may have an account set up incorrectly, please check or give us a call to discuss.